Bitcoin Halving 2024: Key Details to Understand

The Bitcoin halving event is a highly anticipated and eagerly awaited occurrence in the ever-evolving world of cryptocurrency. As 2024 approaches, cryptocurrency enthusiasts diligently mark their calendars in anticipation of the next Bitcoin halving. This guide will provide you with a comprehensive understanding of this significant event.

Bitcoin (BTC) halving is one of the most highly anticipated events within the Bitcoin network. This crucial moment occurs when the production of new Bitcoins is cut in half. The primary objective behind this phenomenon is to slow down the inflation rate, consequently exerting upward pressure on the value of Bitcoin.

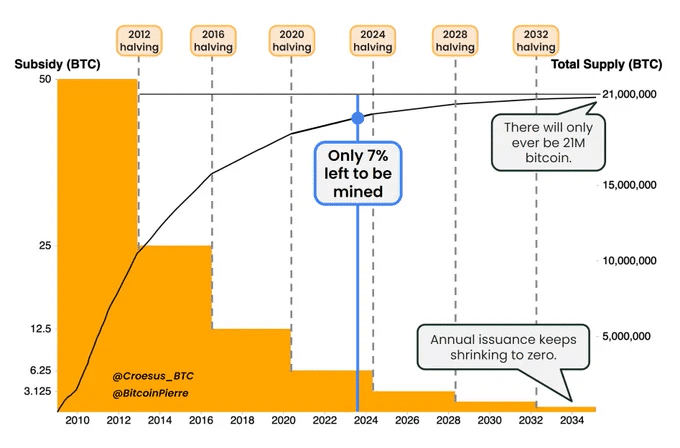

Traditionally, Bitcoin halving is strategically scheduled to happen roughly every four years, specifically after completing every 210,000 blocks. As of the time of composing this piece, we have already witnessed three instances of Bitcoin halving. The inaugural event occurred in 2012, followed by the second in 2016. The most recent Bitcoin halving occurred in 2020 when Bitcoin miners were rewarded with 6.25 Bitcoins for each successfully mined block.

Fast forward to 2024, and we are on the verge of the next Bitcoin halving, which will bring the block reward down to 3.125 Bitcoins. This imminent event has sparked excitement among industry stakeholders, even as it is widely recognized that the impact of each halving event is expected to diminish as the block reward approaches its ultimate reduction to zero.

The Concept of Bitcoin Halving

In essence, Bitcoin halving represents the systematic reduction of the Bitcoin block reward subsidy. In strict adherence to the Bitcoin blockchain protocol, this pivotal event transpires at regular intervals—precisely after every 210,000 blocks have been successfully mined, corresponding to approximately four years. Consequently, Bitcoin miners experience a significant halving of the reward conferred upon them for processing transactions. This landmark event effectively slashes in half the rate at which new Bitcoins are introduced into circulation, thereby serving as a mechanism for enforcing synthetic price inflation until the entirety of the 21 million Bitcoin limit is attained.

This remuneration system is destined to endure for the foreseeable future, with the halving mechanism set to cease operation upon reaching the stipulated limit of 21 million Bitcoins. At that juncture, miners will pivot towards earning transaction fees network users pay for processing transactions. This fee-based structure ensures miners maintain their incentive to continue mining, thus safeguarding the network’s integrity.

To contextualize this concept, envision a scenario where the world’s gold production is halved every four years. In a reality where gold’s worth is intrinsically tied to its scarcity, this theoretical “halving” of gold output at regular intervals would inevitably drive its market value to greater heights.

The Significance of Bitcoin Halving

The Bitcoin halving event holds immense importance, serving as a pivotal moment in the cryptocurrency’s evolution. As Bitcoin nears its ultimate supply limit of 21 million coins, each halving event marks a significant reduction in the rate of new Bitcoin creation. As of October 2021, approximately 18.85 million Bitcoins are already in circulation, leaving just around 2.15 million to be mined through rewards.

Every Bitcoin halving introduces notable changes designed to enhance network growth and efficiency. The core change involves cutting the mining rewards in half, resulting in a substantial decrease in inflation. Interestingly, this reduction in mining rewards doesn’t deter miners, as they anticipate a corresponding surge in Bitcoin’s value.

A well-established economic principle dictates that reduced supply and consistent demand often lead to higher prices. Consequently, Bitcoin’s price tends to surge following each halving event, making these events historically correlated with the cryptocurrency’s significant bull runs.

Recapping Past Bitcoin Halvings

On November 28, 2012, Bitcoin experienced its inaugural halving event, transpiring when BTC’s value hovered around the $12 mark. Fast forward a year later, and the cryptocurrency had ascended to nearly $1,000 per unit. The second halving, which unfolded on July 9, 2016, saw Bitcoin’s price dip to $670, only to surge to $2,550 by July 2017. Notably, Bitcoin reached a prior pinnacle of approximately $19,700 in December 2017. The most recent halving in May 2020 found Bitcoin priced at $8,787, but it ultimately skyrocketed to its all-time zenith of nearly $69,000 by November 2021.

The Bitcoin halving ceremony is a symbolic manifestation of its inherently deflationary qualities. This concept has been a fundamental pillar in support of Bitcoin since its inception. Thanks to its decentralized nature, Bitcoin remains immune to the whims of governments or central banks seeking to inflate their currency supply, firmly adhering to its fixed and unalterable total supply.

Bitcoin Halving 2024: Anticipations

The next halving event is expected in 2024 as we progress. If historical trends persist, we may see a post-halving bull run akin to the one witnessed after the 2020 halving, likely commencing in early 2022. Bitcoin enthusiasts are eager to notice whether this event will trigger another significant surge or if the trend will smooth out.

Considering historical returns, it’s apparent that the substantial gains observed during previous halvings are gradually diminishing. This smoothing effect could be a result of maturing market dynamics. Only time will unveil the proper course of events, with close attention towards the anticipated March 2024 halving.

Final Thoughts

The Bitcoin halving event is crucial in regulating the cryptocurrency’s circulating supply, ultimately bolstering its market value. Notably, the rewards system is set to continue for well over a century until the proposed 21 million Bitcoin limit is reached. Beyond that point, miners will rely on transaction fees as their primary source of compensation for processing transactions. The Bitcoin halving remains a pivotal event, shaping the future trajectory of this groundbreaking digital currency.

DISCLAIMER: It's essential to understand that the content on this page is not meant to serve as, nor should it be construed as, advice in legal, tax, investment, financial, or any other professional context. You should only invest an amount that you are prepared to lose, and it's advisable to consult with an independent financial expert if you're uncertain. For additional details, please review the terms of service, as well as the help and support sections offered by the provider or promoter. While our website strives for precise and impartial journalism, please be aware that market conditions can shift unexpectedly and some (not all) of the posts on this website are paid or sponsored posts.